- Home/

- Other State Exams (Other State PSC)/

- Article

Revision notes: Banking System in India- Money Market Notes for UPSC/PCS Exam

By BYJU'S Exam Prep

Updated on: September 13th, 2023

Banking Structure in India: The current Banking Structure in India has evolved over several decades, is complex, and has been fulfilling the economy’s credit and banking needs. In today’s Banking Structure in India, there are several layers to cater to the distinct and varied needs of different customers and borrowers. The Banking Structure in India played a critical role in mobilizing deposits and encouraging economic development. The performance and strength of the banking structure improved noticeably after the financial sector reforms (1991).

In this article, we will be looking into the key concepts of the Banking Structure in India including Pubic Sector Banks, Private Sector Banks & Cooperative Banks system structure, and also the Money market and various components of the money market.

Table of content

Banking System in India

The banking structure is divided into many parts like Capital Market, Money Market, etc.

Money Market

- In this, borrowing and lending of funds take place up to 1 year.

- It is used for short-term credit.

- It includes Reserve Bank of India, Commercial Banks, Cooperative Banks, Regional Rural Banks, some NBFC’s, etc.

Composition of Money Market

The Indian Money market consists of the organized sector and unorganized sector. But here, we will put a focus on the organized sector.

Organized Sector:

It is divided into two categories:

A. Banking

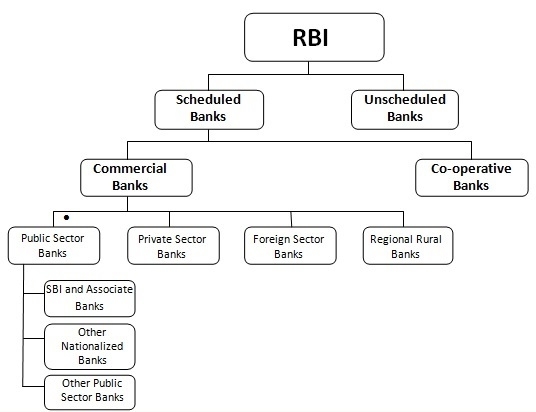

Classification of Banks based on the schedule of RBI Act 1934

All banks (Commercial Banks, RRB, Cooperative Banks) can be classified into scheduled and non-scheduled banks.

1. Scheduled Banks

- Banks those are listed in the second schedule of RBI Act, 1934.

- Eligible for obtaining loans from RB on Bank Rate.

2. Non- Scheduled Banks

- Banks that are not listed in the second schedule of RBI Act, 1934.

- Generally, not eligible for obtaining loans from RBI.

- Keep CRR with itself, not with RBI.

Also, check Bank PO Salary, Bank Clerk, SO & RBI Salary Structure in India.

Commercial Banks

- It is divided into two parts i.e. Public and Private Sector Banks.

- Regulated under Banking Regulation Act 1949.

- They can accept deposits, can provide loans and other financial services to earn a profit.

(a) Public Sector Banks

- In these banks, the majority of shares (more than 50%) are held by Government.

- Currently, in India, there are 21 Public sector banks after the merger of SBI with their associate banks and Bhartiya Mahila Bank (BMB).

- The Nationalization of banks was done by the government in two stages:

The first stage of nationalization took place in July 1969, in which fourteen banks were nationalized.

The second stage of nationalization of Banks took place in April 1980, in which six banks were nationalized.

Objectives of Nationalization of Banks:

1. Reducing Private Monopolies

2. Social Welfare

3. Expansion of Banking Facilities

4. Focus on Priority Sector Lending

(b) Private Sector Banks

- In these banks, the majority parts of shares are not held by the government.

- Private sector banks consist of both Indian Banks as well as foreign banks.

- Private banks which were set up before 1990 (liberalization of the economy) are categorized as Old Banks.

- Private banks which were set up after 1990 (liberalization of the economy) are categorized as New Banks.

- Local Area Banks– Private Banks which are allowed to operate in the limited area are called local area banks and registered under the companies act, 1956. The minimum capital required for these banks is INR 5 crores.

Regional Rural Banks

- Established under RRB Act, 1976.

- Regional Rural Banks are set up by public sector banks.

- The objective of RRB’s is to increase credit flow to rural areas.

- After the Kelkar committee’s recommendations in April 1987, no new RRBs have been opened.

Cooperative Banks

- Established with the aim of funding agriculture, cottage industries, etc.

- Can perform both deposits and lending activities.

- NABARD (National Bank for Agriculture and Rural Development) is the apex body of the cooperative sector in India.

Also, check Beginners Strategy to Crack the Bank Exams.

Composition of Cooperative Banks

1. Rural Cooperative Credit Institutions

(a) Short Term Structure

- Lend up to one year.

- It is further divided into a three-tiered setup.

(i) State Cooperative Bank: Apex body for cooperative banks in the state.

(ii) Central or District Cooperative Banks: Operate at the district level.

(iii) Primary Agriculture Credit Societies: Operate at the village level.

(b) Long-Term Structure

- Lend for more than one year to twenty-five years.

- It is divided into a two-tiered setup:

(i) State Cooperative Agriculture and Rural Development Banks and

(ii) Primary Cooperative Agriculture and Rural Developments Banks

2. Urban Cooperative Credit Institutions

- Set up in urban and semi-urban areas.

- Lend to small businesses and borrowers.

B. Sub Markets

- Sub Market, market to generate resources for investment and to meet the shortage of money for regular activities.

- The government, Financial Institutions, and Industries take part in the submarket.

The composition of the Sub Market-

(i) Call Money Market

- Known as Short Notice Market.

- Generally used for inter-bank borrowing and lending.

- Loans for a range from one to fourteen days.

- It is also divided into two categories-

- A. Call market or Overnight Market (Within one Day)

- B. Short Notice market (up to fourteen days)

(ii) Bill Market or Discount Market

(a) Treasury Bills

- Issued by Government treasury.

- Used for short-term credit.

- Non-interest bearing (Zero Coupon bonds), issued at discount price.

(b) Commercial Bill Market

- Bills other than treasury bills.

- Issued by traders and industries.

(iii) Dated Government Securities

- Used for long-term maturity.

(iv) Certificates of Deposits

- Issued by commercial banks and financial Institution

(v) Commercial Paper

- Issued by corporate, Primary dealers, and financial institutions.

This covered everything you needed to know about the Banking Structure in India. Students can go to BYJU’s Exam Prep website and take mock tests to monitor their banking exam performance. We hope you find this information helpful.

Best Wishes