- Home/

- Other State Exams (Other State PSC)/

- Article

Merger Of Banks in India

By BYJU'S Exam Prep

Updated on: September 13th, 2023

Merger, in other words, means, when two banks pool their assets along with their liabilities to become one single bank. Merging of top ten Public Sector Banks (PSB’s) into four megabanks has been announced by the Central Government recently and thus, diminishing the number of PSB’s from 27 to 12. It is one of the biggest decision of the government for the banking reforms after the nationalization of banks, which happened in 1991.

Table of content

Merger Of Banks in India: Need of Merger; Benefits of Merger; Issues; Various Committees on Bank Merger

LIST OF MERGERS OF PSB’s IN THE RECENT PERIOD

The four Mergers includes the following:

- MERGER 1- Punjab National Bank + Oriental Bank of Commerce + United Bank of India

- MERGER 2- Canara Bank + Syndicate Bank

- MERGER 3- Union Bank of India + Andhra Bank + Corporation Bank

- MERGER 4- Indian Bank + Allahabad Bank

Merger 1 is considered to be the second-largest PSB after SBI. Merger 2, Merger 3 and Merger 4 will be the fourth, fifth and seventh largest PSB respectively.

NEED OF MERGERS

It is necessary to protect the financial system, the depositor’s money, to bridge the geographical gaps, helps to face competitions, etc. In India, PSBs are fragmented, especially in comparison with other key economies. Mergers will help PSBs to build capacity to meet credit demand and sustain economic growth along with protecting the financial system and depositor’s money.

As per the government, three broad gains out of the current mergers are:

- increased capacity to lend

- strong national presence, global reach

- operational efficiency gains to reduce the cost of lending.

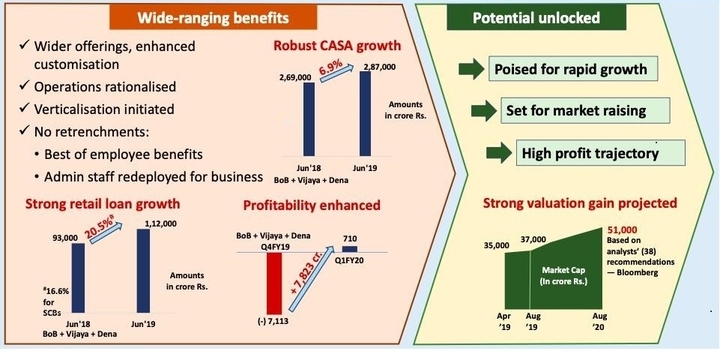

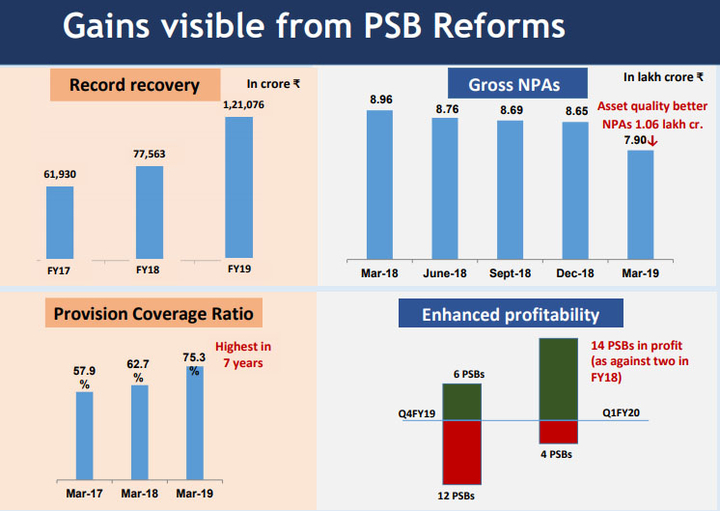

BENEFITS OF MERGERS

Source: PIB

- Small banks are prone to inefficiency which is one of the major reason behind the banking crises. Thus, the merging of banks will enhance the efficiency in each and every level.

- The bigger banks will have greater ability to absorb shocks, reap economies of scale as well as the enhanced capacity to raise resources without depending on the exchequer

- Recognition along with higher rating will be provided to Indian Banks at the International level.

- Ease credit decisions and facilitate quicker resolution plans in case of any economic problem

- In India, technical inefficiency is one of the major reasons behind the banking crisis and is more in case of small banks. So mergers will help to overcome this problem.

- It will also raise the standard of a small national bank to the international level with innovative products and services so that the bank will able to gain greater recognition and higher ratings.

- A large tax benefit will be provided by the mergers and Market share will also get enhanced.

- Reduction of interference in the daily affairs of banks by Board members.

- Monitoring along with control of banks will be easier for the government due to the mergers.

Source: PIB

ISSUES WITH MERGERS

- Problems regarding the top leadership will be there.

- Regional focus and flavour will be reduced by the mergers.

- Many ATM’s along with the branches of banks will either be shifted or closed thus reducing in effect the banking accessibility.

- Clashes among the different organizational cultures will be there since banks from different parts have their regional cultures associated in their organisation.

- More banking competition instead of more banking consolidation is the need of an hour.

- The current situation of unemployment will deteriorate further by the mergers.

- The large size of the banks does not guarantee its future in the globalised scenario. An example can be traced by the fact that during the time of recession, larger global banks were collapsed.

COMMITTEES ON THE MERGER

- Narasimham Committee, 1991 and 1998 – To merge strong banks in Public sector along with the developmental financial institutions and NBFCs.

- Khan Committee, 1997- According to this, banks should be allowed to pledge Corporate bonds as collateral with RBI.

- Verma Committee- It also suggested consolidation as it will lead to a reduction in the cost of operations due to the pooling of strengths.

WAY FORWARD

- Merging of banks will not surely change the scenario without the proper analysis of the governance issues existing over there.

- The focus should be on the framework of the structure for proper management.

- The idea of merger should be implemented properly so as to obtain the desired results.

- Merging of banks should be done while keeping in consideration the time of crises.

More from Us: